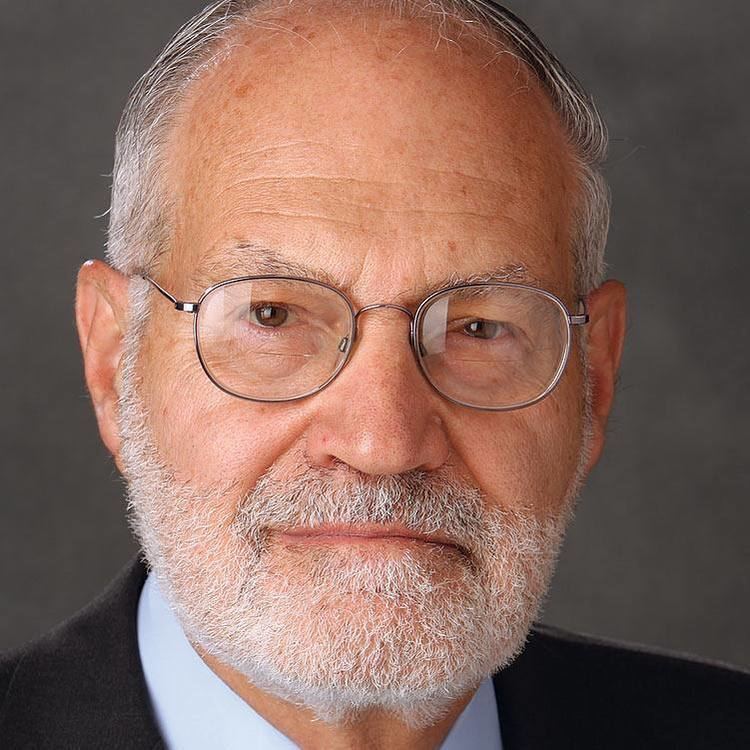

Martin L. Leibowitz, Ph.D.

Induction Speech for Martin L. Leibowitz, Ph.D.

President Mark Girolamo presented FIASI’s inaugural Hall of Fame award to Martin L. Leibowitz, Vice Chairman and Chief Investment Officer, TIAA-CREF Investment Management, Inc. Mr. Girolamo’s induction follows.

Today, it is my great honor to inaugurate the Fixed Income Analyst Society “Hall of Fame.” And it is an even greater honor to induct Marty Leibowitz as our first member.

Acting through our Board of Directors, the Fixed Income Analysts Society decided this year to establish a Hall of Fame to recognize the lifetime achievements of outstanding practitioners in the advancement of the analysis of fixed-income securities and portfolios.

It would be impossible to find a more appropriate candidate for our inaugural induction than Marty Leibowitz.

Marty’s sterling credentials are well known to most of us. After receiving B.A. and M.S. degrees in mathematics from the University of Chicago, he obtained his Ph.D. in mathematics from the Courant Institute of New York University.

In 1969, he joined the bond department of Salomon Brothers with the informal title of “house mathematician.” By 1991, Marty had risen to become Research Director of Salomon’s 450-member global equity and fixed- income research department and a member of Salomon Brothers Executive Committee. In 1995, Marty was appointed Executive Vice President and Chief Investment Officer for the College Retirement Equities Fund (CREF), Chairman of the CREF Finance Committee, CREF Trustee, and Teachers Insurance and Annuity Association Trustee. Marty already has made a tremendous impression on his new colleagues; he recently was promoted to Vice Chairman of CREF and Teachers.

Marty has been a prodigious writer. Together with the legendary Sidney Homer, he authored the now famous, Inside the Yield Book in 1972 and just last month published his latest article, “Benchmark Departures and Total Fund Risk: A Second Dimension of Diversification” in the Financial Analysts Journal.

Marty’s publishing feats were even more impressive considering his growing administrative responsibilities at Salomon Brothers. Somehow over the years, he found time to make written contributions on a wide spectrum of financial topics including security valuation, asset allocation, asset/liability management, spread duration, and price/earnings ratios. Befitting its enormous quality and creativity, his work has received an astonishing eight Graham and Dodd awards for excellence in financial writing.

His remarkable career at Salomon Brothers coincided with the spectacular evolution of the global capital markets. Along with his colleagues, Marty was instrumental in facilitating the development of mortgage- backed securities, fixed-income indices, zero coupon bonds, portfolio dedication and immunization, and bond portfolio measurement tools.

For much of his career, Marty operated in an era prior to the creation of a ranking system for fixed-income analysts by Institutional Investor. If such a ranking system had existed, Marty would have walked away with No. 1 rankings in strategy and quantitative research for most of his 25-year reign at Salomon Brothers.

We all owe a tremendous intellectual and career debt to Marty. John Maynard Keynes once said, “the ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist.”

Like the practical men of Keynes, a generation of bond portfolio managers and researchers, whether they realize it or not, are operating in a paradigm that Marty helped to create.

Although none certainly rival our newly-established FIASI Hall of Fame, Marty has received numerous honors from other organizations. This year, he received the Nicholas Molodovsky Award for Lifetime Achievement from the Association for Investment Management and Research. Marty is a Governor and President of the New York Academy of Sciences and is a member of the Board of Overseers for New York University’s Stern School of Business. He is also a member of the Board of the Institute for Quantitative Research in Finance and is an Associate Editor of the Financial Analysts Journal.

Over the years, Marty has been a great friend to the Fixed Income Analysts Society. He generously took time from his increasingly busy schedule at Salomon Brothers to speak at many of our annual bond conferences.

Today, we honor Marty not only for the enormous contributions that he has made to the realm of security analysis and portfolio management, but also for his class, unselfish giving, and professionalism in the advancement of our field. He serves as an inspirational model for all of us in the fixed-income community.

In professional sports, induction into the “Hall of Fame” implies retirement. Fortunately, this is not the case for Marty with the FIASI “Hall of Fame.” We all look forward to many more articles and books from Marty over the coming years. Given his unique vantage point of having served as a global research director at a premier investment banking firm and now as Chief Investment Officer at one of the largest insurance firms in the world, Marty still has so much to teach all of us about the global capital markets.

Marty, on behalf of the Fixed Income Analysts Society, it is my great pleasure to present you with this engraved Tiffany’s crystal, symbolic of our tremendous respect for your great achievements and for you personally, and to induct you as the very first member of the Fixed Income Analysts Society’s Hall of Fame. Best of all, we are also pleased to report your permanent induction into our Society, with the annual dues waived. But you will still have to pay if you come to one of our regular luncheons.